Financial planning can mean long nights fixing spreadsheets. You struggle with wrong rolling forecasts. You also deal with scattered data that makes decisions hard. Microsoft Fabric, along with D365 F&O, changes this situation. It provides combined data pipelines and automation. This helps you get smart forecasts and make your financial processes easier.

Key Takeaways

Microsoft Fabric brings together financial data. This cuts down on mistakes and makes forecasts better by up to 40%.

Automated reports save time. They help teams make better decisions. This lets finance teams work on strategy instead of doing manual tasks.

Self-correcting forecasts change with new data right away. This keeps your financial planning accurate and ready for market changes.

The Pain of Inaccurate Forecasts

Fragmented Financial Data

You have big problems when your financial data is separated. Different systems make a messy place where information is spread out. This makes it hard to create accurate rolling forecasts. Old forecasting methods often think the future will be like the past. This can cause mistakes when unexpected changes happen.

More than 70% of organizations say they have isolated data. This can lead to differences of up to 18%. When finance teams use different data sources, they face the same problems. Over 60% report an average difference of 18%. These issues make it hard for you to make smart decisions.

Separated financial data also causes manual data transfers and delays in checking numbers. A huge 62% of mid-sized companies have slow month-end closes because their systems don’t work together. Also, 54% have extra audit questions because of data mismatches. This separated setup makes reporting harder and increases the work needed to combine numbers. You might deal with version control mistakes and mismatched timelines, which hurts the trustworthiness and speed of your financial reports.

Manual Reconciliation Challenges

Manual reconciliation is another big problem in financial planning. This process is detailed but takes a lot of time. Bigger companies have even more demands because of many transactions. You could spend days or weeks each month reconciling accounts, checking internal records against bank statements, and finding mistakes.

Doing this by hand raises the chance of human error, which can cause mistakes. As your business grows, the rising number of transactions can overwhelm manual systems, causing delays. Mistakes in reconciliation can slow down financial reports, making it hard to make quick decisions.

Think about these effects of manual reconciliation:

Slow financial reports make it hard to decide quickly.

Wrong data can lead to poor strategic choices.

Long closing times stop fast financial insights needed for good planning.

These problems create a cycle of inefficiency that can hold back your organization’s growth. By fixing these issues, you can open the door to better and more flexible forecasting, leading to smarter financial choices.

The Fabric Solution for Smart Forecasts

Unified Data Pipelines

Microsoft Fabric changes financial planning by making data pipelines work together. These pipelines act as one source of truth. They get rid of the mess caused by separated data. With Microsoft Fabric, you can easily combine different data sources. This helps cut down on having many copies of data, which can cause mistakes.

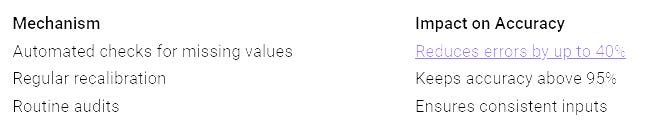

Unified data pipelines greatly improve forecasting accuracy. Here’s how:

By using these methods, you can trust that your forecasts are based on correct and steady data. Microsoft Fabric’s OneLake gives a single storage area. This lets all parts read and write data in the same way. This feature helps solve the problem of data silos that old methods often create.

Automated Reporting and Insights

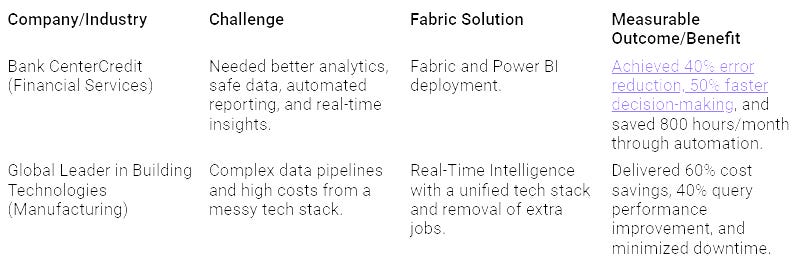

Automated reporting and real-time insights change the game for financial teams. With Microsoft Fabric, you can create reports without the boring manual work that slows you down. Automated reporting tools give you real-time data analysis. This helps you make smart decisions quickly.

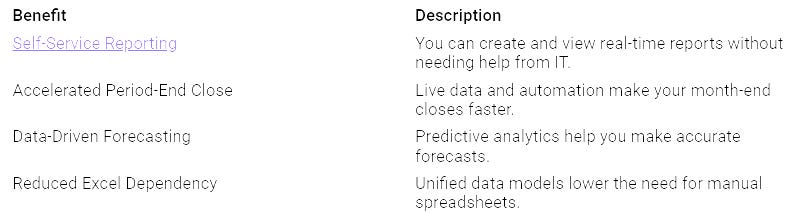

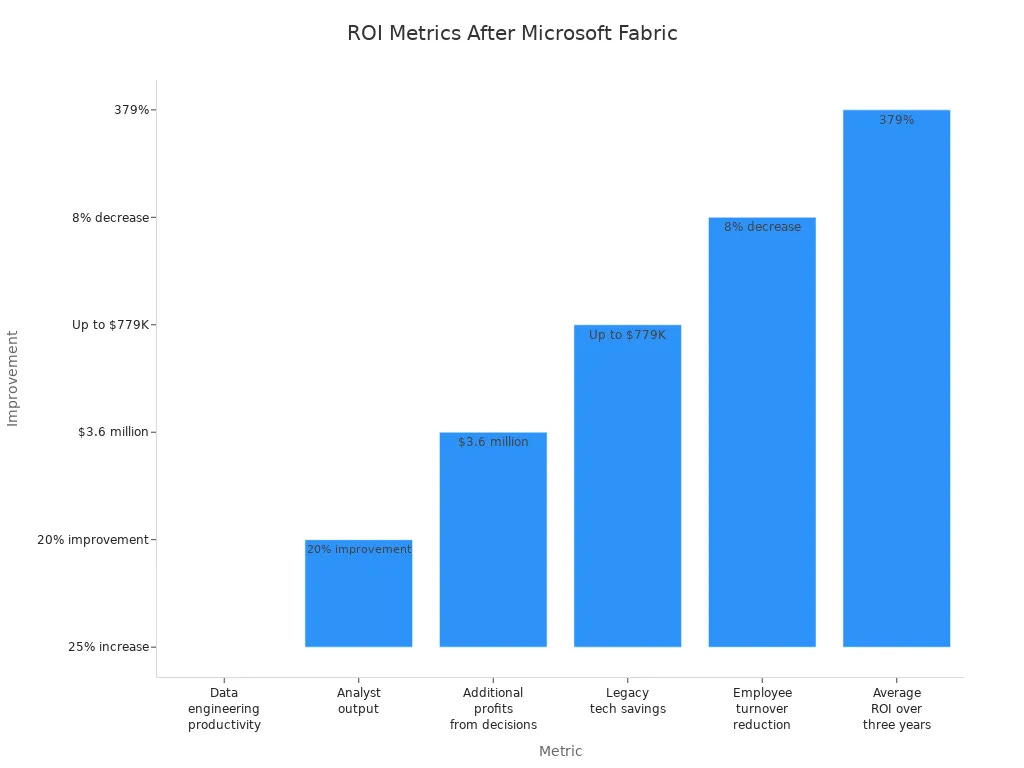

Here are some benefits companies have seen after using automated reporting with Microsoft Fabric:

The ability to access live data connections means your information is always up to date, which reduces mistakes. You can cut your accounting cycle close from two weeks to just one day. This speed lets you focus on planning instead of getting stuck in data checks.

Dynamic and Accurate Forecasting

Self-Correcting Forecasts

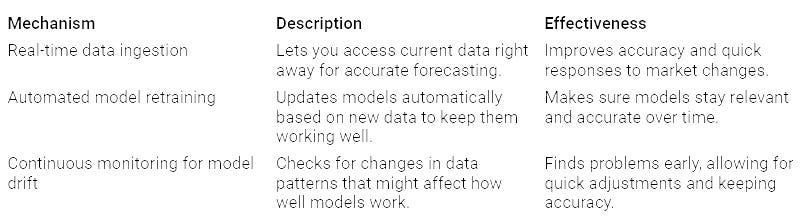

With Microsoft Fabric, your forecasts can fix themselves. They change automatically when new transactions happen. Real-time data ingestion lets you see current information right away. This helps improve accuracy and quick responses to market changes. Automated model retraining keeps your forecasting models up to date. They change based on new data, so they work well over time. Continuous monitoring for model drift checks for changes in data patterns. This helps you find problems early, so you can make adjustments to keep accuracy.

Here are some key ways that help self-correcting forecasts:

By automating these tasks, you need less manual work. This change lets your team focus on analyzing drivers and improving forecasts instead of spending time managing data.

Scenario Modeling with Power BI

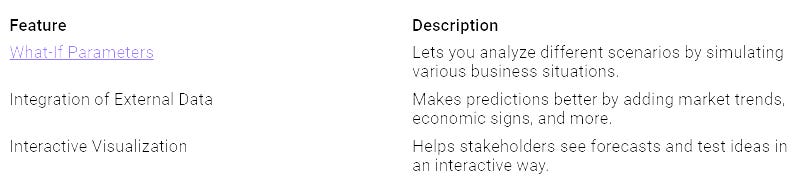

Scenario modeling in Power BI makes your financial planning more accurate. It lets you test different business situations using what-if questions. This feature helps you analyze different outcomes based on changing inputs. You can also add outside data, like market trends and economic signs, to make predictions better.

Here are some features that improve scenario modeling:

Also, anomaly detection in Power BI helps you spot unexpected patterns in financial data quickly. This ability is important for fixing potential problems and adjusting forecasts. By finding anomalies, you can make more accurate and timely decisions, which improves your financial results.

Microsoft Fabric and D365 F&O change how you plan finances. You move from slow manual work to fast, accurate forecasting. This change helps you make better decisions quickly and with more confidence.

Think about the benefits:

As finance leaders, you get a better edge with improved data accuracy and teamwork.

Use these advancements to help your organization grow.

FAQ

What is Microsoft Fabric?

Microsoft Fabric is a single data platform. It makes financial planning easier by bringing together data sources and automating reports.

How does Fabric improve forecasting accuracy?

Fabric improves forecasting accuracy by using real-time data, automatic model updates, and regular checks for changes in data patterns.

Can I integrate Microsoft Fabric with existing systems?

Yes, Microsoft Fabric can easily work with current systems like D365 F&O. This creates a smooth flow of data for better financial insights.