How to Perform Risk Analysis in Financial Data with Microsoft Fabric

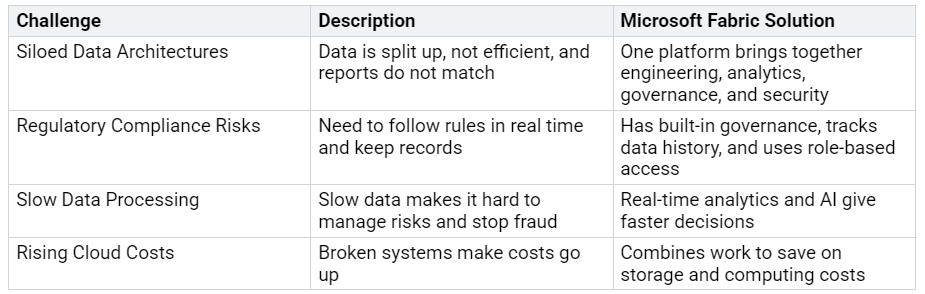

Financial companies often have broken systems, strict rules, and slow data work. Microsoft Fabric helps with risk analysis by putting all data in one cloud platform. The table below shows how Fabric solves common problems:

Microsoft Fabric’s lakehouse design can handle big financial projects. It helps manage risks quickly, safely, and before problems gro…