In Business Central, having accurate data is crucial for effective financial reporting and decision-making. However, you may encounter mistakes in data entry that can disrupt your operations. These errors can undermine trust in your financial reports, leading to poor choices. Understanding how to implement Business Central Data Corrections is essential. With tools like change tracking, you can enhance data management and maintain reliable information. This approach helps your organization operate efficiently and avoid costly mistakes.

Key Takeaways

Correct data is very important for good financial reports and decisions in Business Central.

Fixing invoice errors quickly helps keep reliable financial records and prevents expensive mistakes.

The Dimension Tool makes it easy to change dimension values without undoing transactions, which helps with accurate financial reporting.

Regularly review your data and create clear rules for entering data to keep information high-quality.

Using automatic checks can help find duplicate entries and make data more accurate overall.

Invoice Corrections

Fixing invoices is important for keeping your finances correct. Mistakes in invoices can cause big problems. These problems include errors in financial reports and breaking rules. Some common invoice mistakes are:

Mistakes from typing data by hand

Different ways of making invoices

Missing information on vendor invoices

Not following rules

Slow payment processing

Fixing these mistakes quickly helps keep your financial records trustworthy.

Redoing Invoices

If you need to redo an invoice, follow these steps to get it right:

https://portal.azure.com/

.

Click on the ‘Cost Management + Billing’ tab on the left side.

Choose ‘Invoices’ from the list.

Find the invoice you want to redo and click its name.

On the invoice summary page, click the ‘Regenerate’ button on the right.

In the ‘Regenerate Invoice’ box, update the ‘Sold To’ info by clicking ‘Edit Sold To’.

In the ‘Edit Sold To’ box, change the ‘Sold To’ info with new details.

After updating, click the ‘Regenerate’ button to redo the invoice with the new info.

Redoing invoices correctly is very important. If you make mistakes, you could face problems:

You might cancel the original entry with a negative sign.

Make sure the reverse entry matches the original document number and date.

Make the correct entry after reversing.

Also, think about sending the customer a new invoice with the old one for reference. Making a credit memo to show the mistake can help keep things clear.

Reversing Invoices

Reversing invoices is another key way to fix mistakes. You can reverse an invoice if it should not have been posted or if there are big errors. Here’s how to do it:

If the whole document is wrong, use the Correct function to make a reversal credit memo and a new invoice.

If you just need to reverse the whole invoice, click the Cancel button to reverse it.

For partial reversals, use the Create Corrective Credit Memo function to change specific line items on an invoice.

Reversing invoices correctly is important for your financial records. It helps keep your accounting data accurate and makes sure you follow the rules.

Partial Reversals

Sometimes, you may only need to reverse part of an invoice. Follow these steps to document partial invoice reversals correctly:

Select Search (

Alt+Q) Posted Purchase Invoices, and then choose the related link.On the Posted Purchase Invoices page, pick the posted purchase invoice you want to reverse, and then choose the Create Corrective Credit Memo action.

Change the information on the lines based on the agreement, like the number of items returned or the amount to refund.

Choose the Apply Entries action.

On the Apply Vendor Entries page, select the line with the posted purchase document you want to apply the purchase credit memo to, and then choose the Applies-to ID action.

In the Amount to Apply field, enter the amount you want to apply if it is less than the original amount.

Choose the OK button. When you post the purchase credit memo, it applies to the specified posted purchase documents.

Finally, choose the Post action.

By following these steps, you can make sure your partial reversals are documented correctly, keeping your financial records accurate.

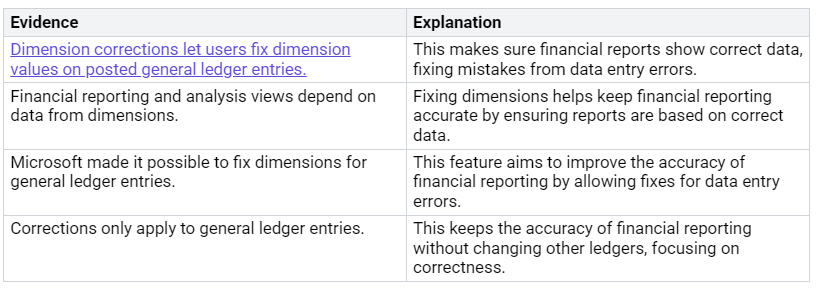

Dimension Corrections

Dimension corrections are very important for making sure financial reports in Business Central are correct. They let you change dimension values on posted general ledger entries. This helps fix mistakes that can happen when entering data. Correct dimensions make sure your financial reports show the real performance of your business. When you fix dimensions, you keep your financial reporting accurate, which is key for making good decisions.

Correcting G/L Entries

To fix dimension mistakes in general ledger entries, do these steps:

Look for the General Ledger Entries archive.

On the General Ledger page, find and pick the entry you want to change.

Click the Correct Dimensions action.

In the Draft Dimension Correction page, turn on Update Analysis Views if needed and change the Description if you want.

In the New Dimension Value Code cell, make your changes.

Click Run at the top of the page.

Choose to schedule this change or turn on Run Immediately.

These steps help make sure your corrections are done well. But, you might run into some problems during this process. For example, fixing dimensions can take a lot of time. You also need to check posting restrictions and locked dimension values before making changes. It’s smart to schedule corrections for big datasets to avoid locking issues.

Tip: Always check the correction status and look into any errors that come up. You can see the history of dimension corrections to undo mistakes if you need to.

Using the Dimension Tool

The Dimension Tool in Business Central makes fixing dimension errors easier. This tool lets you change dimension values on posted general ledger entries without reversing transactions. Here are some important features of the Dimension Tool:

You can change dimension values, add dimensions, or remove them for one or more G/L entries.

The tool gives a clear process for picking entries, checking changes, and making corrections.

By using the Dimension Tool, you can make sure your financial reports are based on correct data. This ability is very important for keeping your financial reporting and analysis views accurate.

Manual Applications

Manual applications in Business Central need careful attention. You must follow certain steps before and after posting. This helps keep your financial data accurate and reliable.

Steps Before Posting

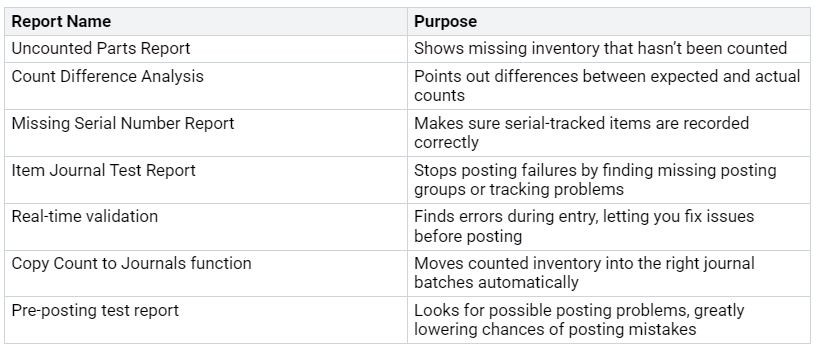

Before you post any manual applications, do thorough checks. These checks help lower the chance of mistakes. Here are some important reports to look at:

By checking these reports, you can find problems early. This helps reduce the risk of wrong entries and keeps things running smoothly.

Steps After Posting

After posting manual applications, you might need to fix mistakes. If there are issues with a posted sales invoice, you can change the workflow conditions. For example, if a Sales Credit Memo workflow causes trouble, change it to skip some actions. This change allows corrections to post successfully. You can add specific rules to the workflow to stop it from triggering during invoice fixes.

Wrong manual applications can cause big problems for account reconciliation. Here are some issues you might see:

Unmatched lines will show a value in the Difference field, meaning discrepancies need fixing.

Bank transactions may not show on bank statements if they were never created.

Transactions may not match due to manual mistakes, like wrong customer names or incorrect amounts.

By following these steps and knowing about possible issues, you can keep accurate records and ensure compliance in your financial reporting.

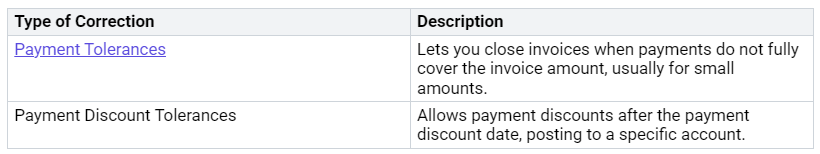

Payment Corrections

Keeping payment records correct is very important for good financial health in Business Central. You might need to make different types of payment corrections. These include cheque corrections, electronic payment corrections, and direct debit corrections. Each type helps keep your financial data trustworthy.

Cheque Corrections

To fix cheque payments, do these steps:

Select Search (

Alt+Q) Posted Purchase Invoices, then pick the related link.Find the posted purchase invoice you want to fix.

On the Posted Purchase Invoice page, click Correct. This makes a new purchase invoice with the same details, so you can change what’s needed.

Click Show Corrective Credit Memo to see the posted purchase credit memo that cancels the first posted purchase invoice.

These steps help you keep accurate records and make sure your financial statements show the right information.

Electronic Payment Corrections

Fixing electronic payment corrections uses several tools and steps. You can manage payments on the Payment Journal page, where you can add payment lines for purchase invoices. Here are some important features:

You can export payments to a file for bank uploads.

Outgoing payments can be linked to vendor or employee ledger entries to close invoices.

The Payment Reconciliation Journal page lets you import bank statement files for easier matching.

By using these tools, you can make your payment processes smoother and improve cash flow management. This leads to correct financial statements and better customer service.

Direct Debit Corrections

To fix direct debit transactions, follow these steps to ensure accuracy:

Create a direct-debit collection entry with details about bank accounts, affected sales invoices, and the direct-debit mandate.

Export an XML file based on the collection entry and send it to the bank.

If the bank cannot process the payment, choose ‘reject entry’ to remove the entry.

Once the bank processes the payment, click ‘Post Payment Receipt’ from the top ribbon. Enter the journal details for the payment to go through. If the bank cannot process the payment, select ‘Reject Entry’ to remove the entry.

By following these steps, you can keep accurate records and follow financial rules.

Doing these payment corrections well helps with accurate cash flow management. You can cut down on manual entries, ensure financial accuracy, and improve how things run. This way, you keep trust in your financial data and support better decision-making.

In conclusion, you can make data more accurate in Business Central by using good correction methods. Here are some helpful tips to follow:

Check your data every three months or every month to fix missing information and wrong entries.

Set clear rules for entering and checking data to keep it high quality.

Use automatic checks to find duplicate entries.

Doing regular data corrections helps your organization do better. It allows for smart decisions, better budget management, and smoother customer experiences. By focusing on data accuracy, you help your business succeed.

FAQ

What should I do if I find an error in a posted invoice?

If you see a mistake in a posted invoice, use the Correct function. This will help you make a credit memo. It lets you cancel the wrong invoice and create a new one with the right details.

How can I correct dimension values in G/L entries?

To fix dimension values in G/L entries, go to the General Ledger Entries page. Pick the entry you want to change, click Correct Dimensions, and update the values you need. This helps make sure your financial reports show correct data.

What steps should I take before posting manual applications?

Before you post manual applications, check important reports like the Uncounted Parts Report and the Item Journal Test Report. These checks help find problems and lower the chance of posting mistakes.

How do I handle payment corrections for electronic payments?

For fixing electronic payments, go to the Payment Journal page. You can add payment lines for purchase invoices and connect them to vendor entries. This process helps keep your financial records accurate.

Why is data accuracy important in Business Central?

Data accuracy is very important in Business Central. It affects financial reporting and decision-making. Accurate data builds trust and helps prevent costly mistakes that can hurt business operations.