Effective sales tax management is very important for your business. When you follow the rules, you lower risks like penalties and audits. This helps your operations run better. Automating your sales tax tasks makes things more efficient. You save time and make fewer mistakes. This lets your finance team work on important tasks. Also, good management helps cash flow. It stops you from paying too much in taxes and avoids late fees. Using these practices can greatly improve your organization’s financial accuracy and success.

Key Takeaways

Good sales tax management lowers risks like fines and audits. This helps your business run better.

Automate sales tax jobs to save time and reduce mistakes. This lets your finance team work on important tasks.

Set up tax areas and groups the right way. This makes sure you follow the rules and collect taxes correctly.

Use automated tax calculation tools in Business Central. This improves accuracy and makes your financial work easier.

Check tax reports often. This helps you keep up with changing tax laws and see your finances clearly.

Sales Tax Setup

Setting up sales tax the right way is very important for your business. It helps you follow tax rules and avoid expensive fines. The first step in good sales tax management is to set up tax groups and areas.

Tax Jurisdictions

Tax jurisdictions are the places where certain tax rules apply. You can manage these areas well by doing these steps:

Type ‘tax jurisdictions’ in the search bar to see current jurisdictions.

To create a new tax jurisdiction, click on +New and fill in the needed details.

Pick a county and click Details to enter the Tax Type, Effective Date, and Tax Below Minimum fields.

Set up tax areas by typing ‘tax area’ in the search bar, then enter a code and description.

In the Tax Area details, choose which tax jurisdictions to include and the order for tax calculation.

On the Customer Card, fill in the Tax Liable and Tax Area Code fields to charge tax correctly.

For certain shipping locations, set the Tax Liable and Tax Area Code on the Ship to Address card.

Setting up tax jurisdictions correctly helps you follow tax rules. It also makes sure you collect and pay sales tax properly. This setup is key for keeping financial accuracy and being ready for audits.

Tax Rates

Tax rates come from setting up tax jurisdictions, tax areas, and tax groups. Tax jurisdictions show areas with specific tax rules, while tax areas show places within those jurisdictions where taxes are collected. Tax groups help organize similar tax types, making it easier to manage different taxes.

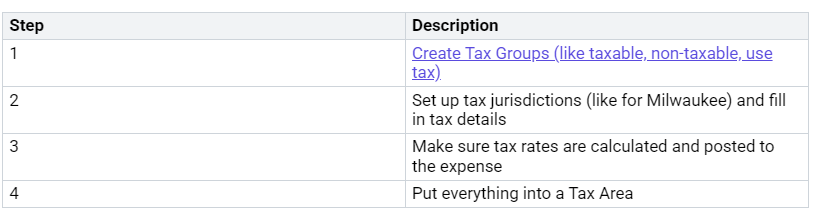

To set up tax rates in Business Central, follow these main steps:

You can use the ‘Set Up Sales Tax’ guide in Business Central for help. This guide assists you in setting up sales tax info for your company, customers, and vendors. Check tax reports often to stay compliant, as tax laws change a lot.

By managing tax rates and jurisdictions well, you can make your sales tax process smoother. This method cuts down on mistakes and improves how your business runs.

Automated Sales Tax Management

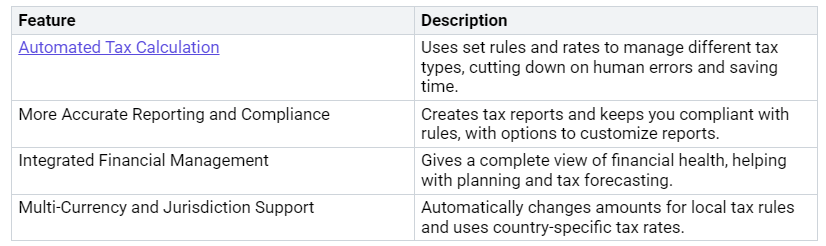

Automated sales tax management makes your tax work easier and more accurate. With Business Central, you can use automatic tax calculation and compliance tools to improve your financial tasks.

Calculation and Posting

Real-time tax calculation is very helpful for your business. It lets you figure out sales tax automatically during sales, which keeps things correct and compliant. Here’s how it works:

Automated Tax Grouping: Business Central sorts items and services into tax groups based on their tax rules. This makes sure the right tax rates are used without needing to do it by hand.

Customizable Tax Jurisdictions: You can set up tax areas and rates to match local needs. This helps you follow local tax laws.

Flexible Pricing Models: You can decide to add or leave out VAT in prices. This is especially helpful for retail sales, making sure sales tax is shown correctly in prices.

The benefits of automatic tax calculation are big. You lower mistakes and save time on tax work. Experts say, “When you use manual methods, there is always a higher chance of mistakes. Automated systems lower those chances, improve accuracy, and give more control.”

Also, the Sales Order Agent in Business Central helps create sales orders by pulling info from emails and attachments. This cuts down on manual entry mistakes, making your sales tax management more accurate.

Compliance and Reporting

Following the rules is very important in sales tax management. Business Central makes compliance easier by creating correct tax reports and returns. This feature helps you meet rules quickly.

Here are some key parts of compliance and reporting in Business Central:

With automatic compliance reporting, you see a big drop in human error. A study shows that 97% of users say they spend less time on tasks when using automated systems. This smart way of checking compliance helps you avoid fines and audits.

Sales Tax Journal in Business Central

The sales tax journal in Business Central is very important for managing your sales tax. It helps you keep track of sales tax accounting steps: collection, holding, and remittance. You need to record sales tax as a liability. It should not be recorded as income or an expense. Making proper journal entries is key for following rules and accurate financial reporting.

Adjusting Customer Ledgers

Adjusting customer ledgers for sales tax keeps your records correct. Follow these steps to make the needed changes:

Pick the General Ledger Setup, then select the related link.

On the General Ledger Setup page, fill in the fields below:

Pmt. Disc. Excl. Tax: Choose this option to calculate payment discounts without sales tax.

Adjust for Payment Disc.: Select this to recalculate tax amounts when posting payments that have discounts.

Unrealized VAT: Choose this if your sales tax areas let you pay sales tax after getting payment.

Click the OK button.

Next, adjust the Tax Jurisdictions by selecting the related link and editing the list. Fill in the required fields to show how payments cover tax and invoice amounts. This process makes sure your customer invoices show correct tax amounts.

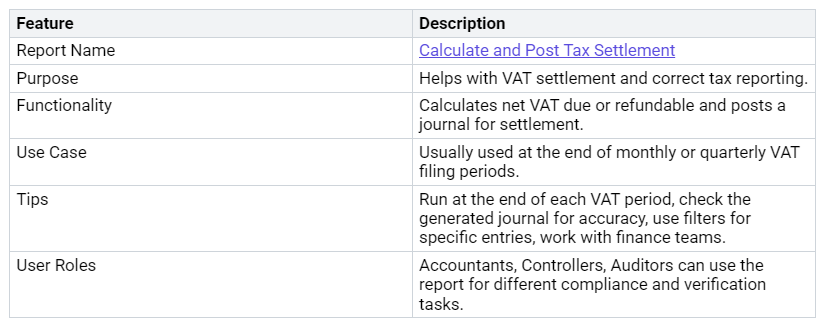

Tax Collected Reports

Making tax collected reports is very important for following rules and financial accuracy. Business Central lets you create these reports easily. Here’s how:

These reports help you keep organized records. They also help you be ready for audits by giving clear proof of your sales tax activities. By keeping detailed records, you can solve disputes during audits more easily.

Integration with Tax Solutions

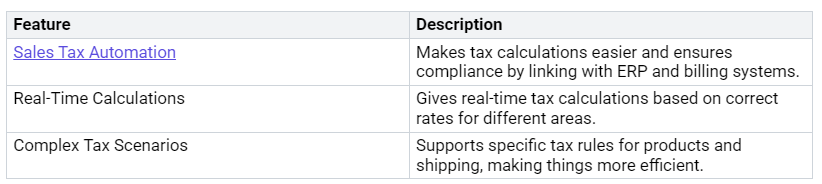

Connecting Business Central with tax solutions makes your sales tax management better. This connection makes processes easier and helps you follow tax rules. You can link up with different providers, like Avalara, to automate tax calculations and reporting.

E-commerce Platforms

If you have an online store, managing sales tax correctly is very important. Connecting Business Central with e-commerce platforms helps you automate tax calculations during sales. This link makes sure you use the right tax rates based on where the customer is. Here are some key benefits:

Real-Time Tax Calculation: Automatically figures out sales tax for each sale.

Address Validation: Makes sure tax rates are correct based on the customer’s shipping address.

Multi-State Tax Handling: Easily manages different tax rates in various states.

By linking your e-commerce platform with Business Central, you lower the chance of mistakes and improve compliance.

Accounting Software

Connecting Business Central with accounting software also makes your sales tax work easier. This link allows data to flow smoothly between systems, which improves accuracy and efficiency. Here are some features of this connection:

Connecting with outside tax solutions is important for following rules. It gives you real-time information and accurate financial reports. This link helps you keep detailed audit trails, which are key for meeting regulations.

Tip: Check your integration settings often to make sure they work well and fix any issues, like old connectors or API limits.

By using these connections, you can improve your sales tax management and focus on growing your business confidently.

In conclusion, good sales tax management in Business Central is very important for your business. By following the right steps, you can stay compliant and lower risks. Here are some important points to remember:

Use the tax jurisdictions list to create new codes and set percentages for different sales taxes.

Make tax group codes and apply them to products or services using the item card.

Set up a specific tax area for places with more than one sales tax.

Enter combinations of tax groups and tax area codes in the Tax Details field to set rates.

Give each tax and tax combination a clear name for easy identification.

Apply the right tax area code to customers and vendors, and check your choices.

As rules change, pay attention to how your choices affect sales tax duties. Improving data visibility and reporting will help you stay compliant and informed. Use available tools, like e-learning modules and reporting guides, to boost your sales tax management.

Keep in mind, good sales tax management is not just about following rules; it is a smart way to help your business grow.

FAQ

What is sales tax management in Business Central?

Sales tax management in Business Central means setting up tax areas, rates, and groups. It helps calculate taxes automatically, keeps you following the rules, and makes reporting easier. This way, you can handle sales tax well.

How do I set up tax jurisdictions?

To set up tax jurisdictions, type “tax jurisdictions” in Business Central’s search bar. Click +New, fill in the needed information, and choose the tax types and start dates for each area.

Can I automate sales tax calculations?

Yes! Business Central can automatically calculate sales tax during sales and purchases. This feature helps cut down on mistakes and keeps you following local tax laws.

How do I generate tax reports?

You can create tax reports by going to the reporting section in Business Central. Use the built-in templates to make reports for tax amounts and settlements, making sure you follow the rules.

What are the benefits of integrating with tax solutions?

Connecting with tax solutions like Avalara improves your sales tax management. It gives you real-time updates on tax rates, automates calculations, and helps you stay compliant in different areas. This saves you time and lowers mistakes.